The audit of the 2022 financial statement of former LaRue County Sheriff Russell McCoy was recently released by State Auditor Allison Ball, wi…

Construction of the $2.8 million project to improve athletic facilities at LaRue County High School is expected to begin this week and will ca…

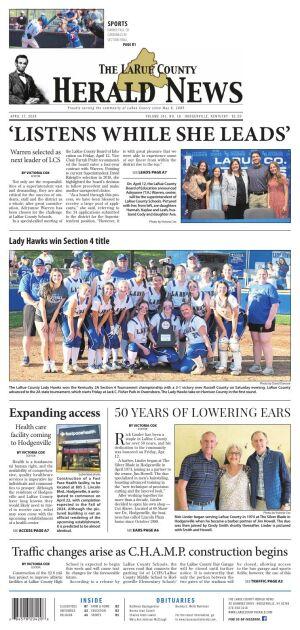

Not only are the responsibilities of a superintendent vast and demanding, they are also critical for the success of students, staff and the di…

Did you know that the average American tosses 4.5 pounds of trash per day? How about that the United States produces 268 million tons of waste…

Health is a fundamental human right, and the availability of comprehensive, quality healthcare services is imperative for individuals and communities to prosper. Although the residents of Hodgenville and LaRue County have long known they would likely need to travel to receive care, relief ma…

Health is a fundamental human right, and the availability of comprehensive, quality healthcare services is imperative for individuals and comm…

Rick Linder has been a staple in LaRue County for over 50 years, and his dedication to the community was honored on Friday, Apr. 12.

The Latest

It was a rare honor to wish our friend Wayne Hayes a happy 103rd birthday on April 13. Wayne has lived a rich and full life touching many peop…

The author of Hebrews cautions people not to miss salvation by drifting past Jesus. The warning comes in response to the threat of rejecting t…

Thought for the week: Life is boring if you don’t laugh, joke around and be a little crazy e…

Let us continue to keep in prayer for the families that have lost loved ones. Pray for the s…

From popular media to conversations online, opinions about the values and behavior of teenag…